Eye Health is Important

As you age, your risk for vision loss can increase due to long-term chronic disease (like diabetes), habits such as smoking, excessive UV exposure, and a family history of eye disease. Since impacts to vision and eyesight may not be noticeable right away, it is important that you take care of your eyes by maintaining a healthy lifestyle and having a dilated eye exam every 1-2 years or as recommended by your eye doctor. Half of all incidence of blindness can be prevented through early detection and treatment.

Medicare beneficiaries, especially those at risk for or diagnosed with a variety of diseases, are entitled to a number of vision-related services. If you need further assistance, please refer to the “Need more help?” section of this page.

Fact Sheets to Share and Print

[doc_library layout=”grid” grid_columns=2 content=”title, link” folders=false preview_style=button_icon include=”49134, 49136, 52907″ search_box=”false” totals=”false”]

For more information, visit:

Welcome to Medicare Physical (Medicare Part B)

The “Welcome to Medicare Physical” is an initial preventive physical examination. Medicare will cover this examination only if it occurs within the first 12 months that a beneficiary has Part B coverage. During this “Welcome to Medicare” physical examination, your doctor will:

- Record and evaluate your medical and family history, current health conditions, and prescriptions

- Review your risk factors for depression and other mood disorders

- Review your functional ability and level of safety (i.e., risk of falls, home safety, hearing impairment)

- Check your blood pressure, visual acuity, weight, and height to get a baseline for your care (Keep in mind the visual acuity screening is not a comprehensive dilated eye exam)

- Discuss end-of-life planning agreements

- Make sure you’re up-to-date with preventive screenings and services, such as cancer screenings and vaccinations

- Order further tests, depending on your general health and medical history

- Following the visit, your doctor will give you a plan or checklist with screenings and preventive services that you need. Ask about eye exams!

For more information, visit:

Medicare.gov-“Welcome to Medicare” preventive visit

Medical Learning Network: Initial Preventive Physical Examination

Routine Eye Exams

Medicare does not generally cover the costs of routine eye exams:

- Medicare does not cover eye exams for eyeglasses or contacts even as a part of some otherwise covered exams (see “Cataract Surgery Benefits” section for an exception). Check with your eye care professional for more information. If you need help with the costs of eye glasses go to our financial assistance resource: vision care financial assistance information.

- Medicare does cover injuries to the eye as they are not considered to be routine in nature. You pay 20% of Medicare’s payment to the provider for the services. The Part B deductible will also apply.

- Medicare Advantage plans (Medicare Part C), which are administered by private companies, may choose to offer vision coverage.

For more information, visit:

Cataract Surgery Benefits

Cataracts affect millions of Americans, and is a leading cause of blindness worldwide. In the U.S., cataract surgery is the most commonly performed surgical procedure in people age 65 and older. A cataract is an opacity or cloudiness in the lens of the eye blocking light from entering through the lens, sometimes resulting in blurred or impaired vision.

Medicare guidelines allow Medicare recipients the choice of receiving conventional intraocular lens (IOL) replacement that is covered by Medicare. A conventional IOL is a small, lightweight, clear disk that replaces the focusing power of the eye’s natural crystalline lens.

Medicare Part B (Medical Insurance) covers a conventional IOL when it is implanted as part of cataract surgery. Medicare does cover the following IOL items and services:

- A conventional IOL implanted during cataract surgery

- Facility and physician services and supplies required to insert a conventional IOL during cataract surgery

- One pair of eyeglasses with standard frames or one set of contact lenses from a Medicare enrolled supplier if you have cataract surgery to implant an intraocular lens. You pay 20% of the Medicare-approved amount for corrective lenses after each cataract surgery with an intraocular lens, and the Part B deductible applies. You pay any additional costs for upgraded frames.

Presbyopia and astigmatism are common eye problems corrected by presbyopia-correcting IOLs (P-C IOLs) and astigmatism-correcting IOLs (A-C IOLs). When you request a P-C or A-C IOL instead of a conventional IOL, Medicare does not pay for the physician and facility services specific to the insertion, adjustment, or other subsequent treatments that are attributable to the functionality of the P-C or A-C IOLs. The beneficiary is responsible for payment of that portion of the charge for the P-C or A-C IOL and associated services that exceed the charge for insertion of a conventional IOL following cataract surgery.

For more information, visit:

For more information on cataract, visit:

Glaucoma Medicare Benefits

A leading cause of blindness, glaucoma affects close to 2.7 million Americans age 40 and older. Glaucoma is an eye disease that causes loss of sight by damaging a part of the eye called the optic nerve. This nerve sends information from your eyes to your brain. When glaucoma damages your optic nerve, you begin to lose patches of vision, usually side vision (peripheral vision) initially. African Americans are at risk for glaucoma at a younger age than other ethnicities. African Americans and people of Hispanic/Latino ethnicity are at increased risk of glaucoma compared to Americans of other racial and ethnic backgrounds.

You are considered at high risk for glaucoma if one or more of these applies to you:

- You have diabetes

- You have a family history of glaucoma

- You are African American and age 50 or older

- You are Hispanic and age 65 or older

Medicare Part B (Medical Insurance) covers glaucoma tests once every 12 months if you meet the high risk criteria for glaucoma. You are responsible 20% of Medicare’s payment to the provider for the services or, if care is sought in a hospital outpatient setting, a standard copayment. The Part B deductible applies to these services. If your doctor recommends you receive services more often than is allowable under Medicare or recommends services that are not provided under Medicare, you may need to pay all costs. Be sure to ask your provider about these costs before you receive treatment.

The tests to screen for glaucoma include:

- Dilated eye examination

- Intraocular pressure measurement

- Direct ophthalmoscopic examination, or a slit-lamp biomicroscopic examination

For more information, visit:

https://www.medicare.gov/coverage/glaucoma-tests

For more information on glaucoma, visit:

Diabetes

If you are living with diabetes, you are at risk for developing diabetes-related eye disease which includes retinopathy and macular edema. Diabetes-related retinopathy occurs when small blood vessels leak and bleed in the retina. The retina is layer of the eye that acts like the film in the camera of the eye to help you see. Diabetes-related retinopathy is a leading cause of blindness in American adults and it affects over one in four of those living with diabetes, while 4% have severe cases of retinopathy.

Diabetes-related macular edema is a swelling that can occur with retinopathy. It occurs when the small blood vessels in the center of the retina, called the macula, become leaky and cause the retina to swell. It can cause your vision to become blurry.

In addition, glaucoma and cataracts are eye conditions that are common among people living with diabetes. Diabetes-related eye disease can affect anyone with diabetes. Often there are no symptoms, so it is important to see your eye care professional for a comprehensive eye exam.

Medicare beneficiaries living with diabetes qualify for the annual glaucoma screening benefit. This benefit includes a comprehensive eye exam. Since people with living with diabetes need to have an eye exam at least once a year, Medicare recipients should be sure to make full use of the yearly glaucoma screening benefit to receive an eye exam that can check for both glaucoma and diabetes-related retinopathy. See Glaucoma Medicare Benefits for more information.

For more information on diabetes-related eye disease, visit:

Age-related Macular Degeneration (AMD)

AMD is a vision disease that causes loss of sight in central vision. Currently, AMD affects the vision of more than 2 million Americans age 50 and older and is a leading cause of blindness. AMD is a progressive disease that, if left untreated, can result in severe vision loss and even blindness.

Medicare Part B may cover certain diagnostic tests and treatment (including treatment with certain injected drugs) of eye diseases and conditions if you have AMD. You pay 20 percent of the Medicare-approved amount for the drug and the provider for the services or a co-payment if the treatment is offered in a hospital outpatient setting and any deductible. The Part B deductible applies to these services. If your doctor recommends you receive services more often than is allowable under Medicare, or recommends services that are not provided under Medicare, you may need to pay all costs. Be sure to ask your provider about these costs before you receive treatment.

For more information, visit:

https://www.medicare.gov/coverage/macular-degeneration-tests-treatment

For more information on AMD, visit:

Prescription Drug Benefits (Medicare Part D)

All Medicare beneficiaries should know that help is available for the costs of prescription drugs, including those taken for their eyes. It is important to follow your eye doctor’s instructions for how often to take eye medications. Missed dosages can lead to increased risk of vision loss.

Medicare prescription drug coverage is an optional benefit offered to everyone who has Medicare. This includes eye medications. You must enroll to access this benefit. Note, there are penalties for people who miss enrollment deadlines.

Medicare plans will vary depending on where you live, and each plan is different. This can be confusing, but there are resources which can help you to understand your choices.

MEDICARE: Extra Help with Medicare Prescription Drug Plan Costs

https://www.ssa.gov/benefits/medicare/prescriptionhelp/.

Medicare beneficiaries can qualify for Extra Help with their Medicare prescription drug plan costs. The Extra Help is estimated to be worth about $5,000 per year. To qualify for the Extra Help, a person must be receiving Medicare, have limited resources and income, and reside in one of the 50 States or the District of Columbia. For further assistance with the program, visit the PAN Foundation website: https://www.panfoundation.org/extrahelp/.

For More Information

Medicare

www.Medicare.gov

1.800.MEDICARE (1.800.633.4227)

Social Security

Financial assistance is available for those who meet certain income and resource limits.

http://www.socialsecurity.gov/prescriptionhelp

1.800.772.1213

Medicare Drug Coverage (Part D)

https://www.medicare.gov/drug-coverage-part-d

Need more help?

Centers for Medicare and Medicaid Services

1.800.633.4227 or www.medicare.gov

Social Security

1.800.772.1213 or www.socialsecurity.gov

State Health Insurance Assistance Program (SHIP)

Each state has a SHIP program funded by Medicare which provides objective information about Medicare related issues. One-on-one counseling and assistance is available to people with Medicare and their families. To find the SHIP program in your state go to: https://www.shiptacenter.org.

Good Days

The Good Days grant program is for patients that have insurance thru Medicare or Medicare Advantage plans. Good Days may cover eye drug balances after insurance if you qualify. To learn more, visit: https://www.mygooddays.org/patients.

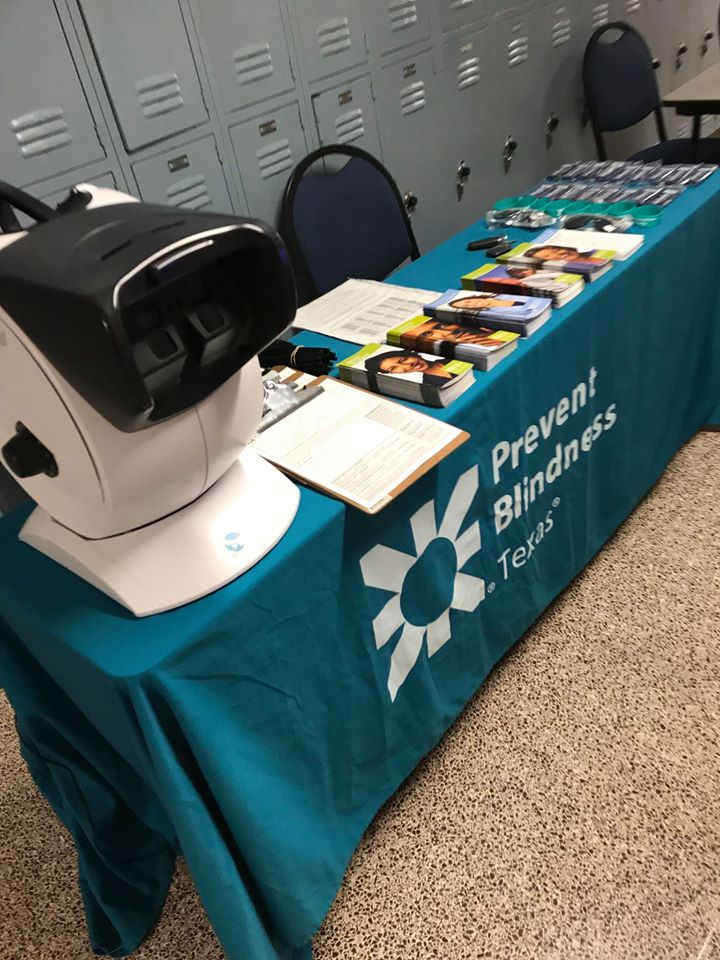

Call Prevent Blindness at 800.331.2020 to learn more.

Medicare: Medicare is the federal health insurance program for people who are 65 or older, certain younger people who have disabilities, and people with permanent kidney failure requiring dialysis or a transplant. The different parts of Medicare help cover specific services.

Medicare Part A (Hospital Insurance): Part A helps cover inpatient care in hospitals, including critical access hospitals, and skilled nursing facilities (not custodial or long-term care). It also helps cover hospice care and some home health care. Beneficiaries must meet certain conditions to get these benefits. Most people don’t pay a premium for Part A because they or a spouse already paid for it through their payroll taxes while working.

Medicare Part B (Medical Insurance): Part B helps cover doctors’ services and outpatient care. It also covers some other medical services that Part A doesn’t cover, such as some of the services of physical and occupational therapists, and some home health care. Part B helps pay for these covered services and medical supplies when they are medically necessary. Most people pay a monthly premium for Part B.

Medicare Part C (Medicare Advantage): A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits.

Medicare Part D (Prescription drug coverage): Medicare prescription drug coverage is available to everyone with Medicare. To get Medicare prescription drug coverage, people must join a plan approved by Medicare that offers Medicare drug coverage. Most people pay a monthly premium for Part D.

Original Medicare: This includes coverage of Medicare Part A and Part B.

Visual acuity screening: The purpose of a vision screening is to identify vision problems in a treatable stage, provide education, and provide a referral to an eye care provider for a comprehensive dilated eye exam (if needed).

Comprehensive dilated eye exam: A comprehensive dilated eye exam diagnoses eye disorders and diseases and prescribes treatment.